CoFounder Weekly is a newsletter about startup life. Sections: Tweeter’s Digest, Crossword Puzzle, Founder Stuff, Investor Stuff, Asks & Offers, Weekly Thought. This is not your average newsletter (could be better or worse).

Did somebody forward this to you? Subscribe to get our latest issue every week!

EDITOR’S NOTE

THIS IS OUR BEST ISSUE YET!

Thanks to our readers forwarding this newsletter to their friends, we've almost doubled our subscriber base in the last month! 🎉

If you're the helpful type, we'd love if you could forward this to just one friend this week. It's reaching more awesome readers like you that makes this all worth it.

THANK YOU! 🙏

By: Tanaka Tatsuya (click here to watch GIF)

TWEETER’S DIGEST

CAPTION CONTEST

Last week’s contest: describe this scene in only SIX WORDS. Best caption wins a prize and gets printed in next week’s edition.

Winner: “Cracked perhaps... at least no notch.” - Benny Rubin, Brooklyn NY

Runner-up: “Catflix and purrrrr”- a mouse inside my LES apartment

2nd Runner-up: “When the devs take a break”- Sarah McCullough

FOUNDER STUFF

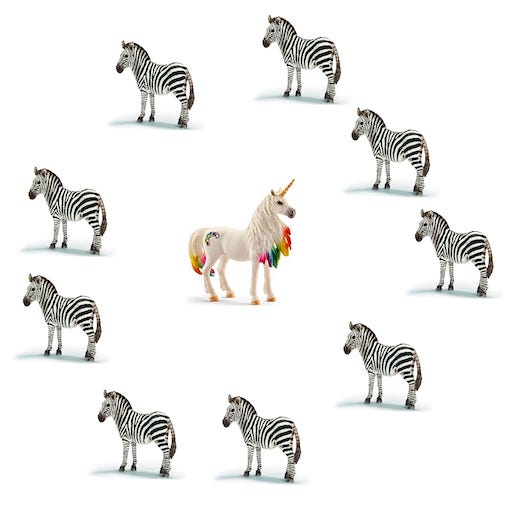

Would you rather be a Unicorn or a Zebra?

This past week there was A LOT of noise around the harsh realities of VC funding sparked by this NYT article. This is a cauldron of mixed opinions that has been waiting to boil over.

Taking VC money is very alluring. However, recent discourse has brought attention to a swelling counter movement of those who are squarely against VC’s main investment thesis — shoot for the moon or die trying.

I empathize with the VC grudge. Startup founders are filled with hopes and dreams of the luxuries that come with VC funding. We daydream about different variations of our hiring plans — the army of engineers to ship, ship, ship and the sea of salespeople who will sell, sell, sell. Dreams of rocket ships and unicorns. 🚀🦄

The hard truth is that most companies don’t get funded. For every FUNDING SECURED celebratory tweet you see, there’s an iceberg of broken dreams whose dreamers are left looking for different paths.

The reasons to hate on VC are numerous: opaqueness of their decision making (who knows what goes on in those partner meetings, we all wonder), lack of diversity in funded founders (the meme of the white male founder in khakis, gingham, and Patagonia holds water), and sometimes questionable ethics and excess (#metoo #cuddleparty).

Despite all the shade being thrown, the retort from VCs is clear and unified: VC money isn’t appropriate for most companies, taking VC money comes with serious trade-offs and expectations, VC money is a massive gamble for all parties (investors and founders), don’t take VC money if you aren’t 100% committed to building a unicorn or dying trying.

The hard truth is that VC are a very specific kind of investor. They only bet on companies they think can result in >$B exits and they’ll push their portfolio companies to get there or die trying.

VCs give you the money to take a shot at changing the world. Most of the time it doesn’t work out and that’s OK because when it does work out the world’s greatest companies are built.

The ironic twist is that founders are partly to blame. Founders have been putting steady pressure on increasing valuations and thus lowering average VC ownership, which has gotten us to this place where VC’s need a grand slam to make their math work.

As Bryce from Indie.vc put it

For you founders who don’t want to be a hollywood-star-unicorn and would be perfectly content building a real Zebra that bleeds black…

Here is a list of all the alternate sources of funding we could find:

PDF: https://www.dropbox.com/s/t8dcqjnmulsorwb/VC%20Alternatives.pdf?dl=0

What do you think? Unicorn or Zebra?

*****

The Ultimate Guide to Remote Work (LINK).

*****

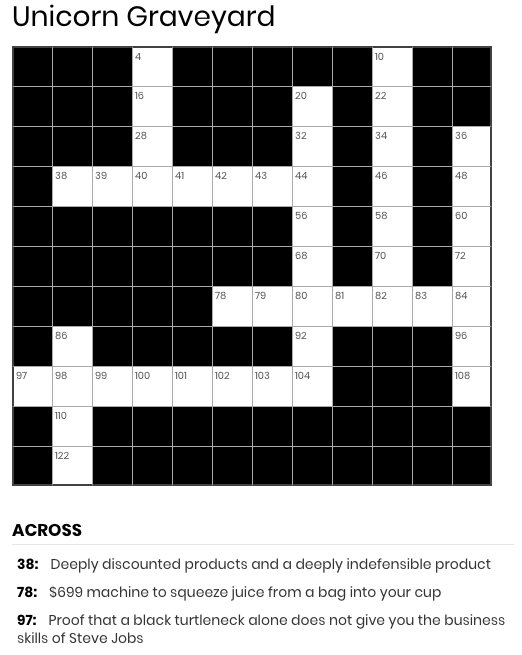

CROSSWORD: UNICORN GRAVEYARD

Do the crossword here: http://cofounder.life/

👉 See the rest of the crossword puzzle here: http://cofounder.life/

By: Sunday Sketch

INVESTOR STUFF

“Measuring the impact of VC Platform Strategy” articulates the difficulty in measuring how investors can add value (LINK). It includes a nifty chart that lays out all the ways investors can add support their portfolio companies though recruiting, networking events, programming, recruiting, etc. But it can be hard to measure.

But how can founders/doers get support if they aren’t affiliated with a VC with a platform? We’re interested in offering ways to support founders (hence the experiment of our “Ask and Offers” section).

OVERHEARDS

“I can’t make a two year commitment. We’re a startup and may not exist then”. - guy wearing Allbirds, Bonobos, and Warby Parker glasses at WeWork (Flatiron, NYC)

“Do people still, like, buy magazines?” - Ace Hotel lobby (NYC)

Hit reply and send us your favorite overheards or funnies and we’ll include them in next week’s newsletter!

ASKS, OFFERS & EXPERIMENTS

Ask: Looking for freelance graphic designer for designing sales and marketing collateral, sales decks, brochures, etc. you’d highly recommend for a temporary project? - Karthik Sridharan

Ask: Looking for interesting food tech PM roles. Know anyone hiring? - Matt Newberg

Ask: Looking for funny writers and illustrators in tech who want to contribute to CoFounder. Got LOL? - Greg Kubin

Offer: First Round is hiring a Chief of Staff in SF

Offer: Hazel (AI Coach for Managers) is looking for their first sales hire. If you know anyone who’s looking for a new chapter in 2019 who might be a fit, have them email wisam@hazelhq.com.

Offer: Got any Asks or Offers? Things like cool job opps, asking for feedback, etc. Send them to us and we’ll include it in an upcoming newsletter 🤳🏾

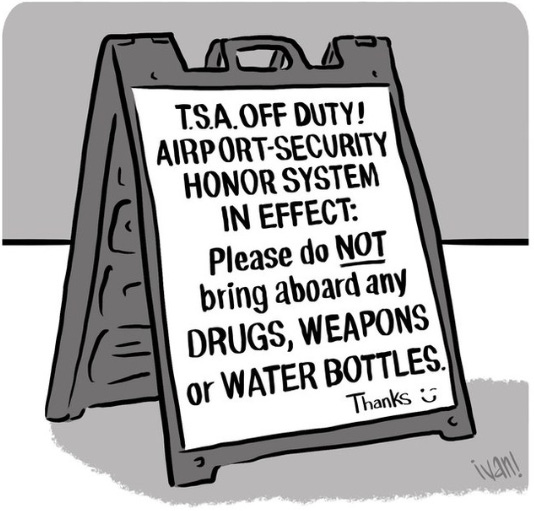

By: Ivan Ehlers

Weekly Thought

Will Baxter was $30k shy of his Kickstarter goal to fund an eco-friendly consumer products brand.

In search for inspiration, Baxter recalled a Will Smith interview . The actor claimed he worked so hard that he was not afraid to die on a treadmill.

Baxter took the concept literally to create a genius fundraising campaign: he would livestream himself walking on a treadmill until he raised the necessary funds.

He bought the domain dontletwilldie.com.

50 hours and 26 minutes later, Will raised $28,411.

This was in 2011, before social media and livestreaming is what it is today. I wonder how much someone could raise with a similar initiative today.

(H/T to CoFounder Weekly reader MJ Coren for sharing the story over drinks at Diamond Lill)

- - - - - - - - - - - - -

Hugs,

Did you like this issue? Help us out and forward it to one friend!